|

|

马上注册,结交更多好友,享用更多功能,让你轻松玩转社区。

您需要 登录 才可以下载或查看,没有账号?注册

×

作者:微信文章

裕元集團

Yue Yuen Industrial Holdings

(0551 HK)

製造韌性凸顯,關注關稅進展

June revenue update shows manufacturing resilience; continue to monitor US tariff developments

買入(維持評級)

BUY (maintain)

|

投資要點/Investment Thesis

投資要點/Investment Thesis

公司發佈二五年六月營收公告

製造業務增長支撐整體表現。 25年6月公司營收6.6億美元,同比+1.5%; 其中製造同比+9.4%,寶勝營收-16.4%,製造業務增長表現亮眼。

1-6月累計營收40.6億美元,累計同比+1.1%; 其中製造同比+6.2%,寶勝營收同比-8.3%,零售業務靜待修復。

美越達成貿易協議,關稅進展順利

美國與越南正式達成貿易協定。 根據協議條款,越南出口至美國的所有商品將被徵收20%關稅,任何經第三地轉運的貨物則需繳納40%關稅。 作為交換,越南同意全面向美國開放市場,允許美國商品以零關稅進入越南。

越南是美國重要的紡織服裝商品進口國之一,美越關稅落地,對服裝品牌和製造商在關稅稅負承擔問題上帶來更多確定性。 同時考慮到越南生產商及美國入口商能夠分別承擔關稅,則關稅屬於雙方能夠承擔的範圍之內。

公司製造業務覆蓋越南,且美國為其第二大主營市場。 24年越南的產能利用率保持較高水準,鞋履出貨量同比增長4%,佔總出貨量的31%; 而美國收入佔比19%,美越協議的簽署使公司出口訂單的穩定性增強。

聚焦產能多元化,製造韌性提升

產能佈局向東南亞拓展。 公司將加速推進中長期產能佈局策略,重點投資勞動力供應充足且基礎設施具備可持續增長潛力的印尼和印度市場,實現製造產能的多元化配置,以應對全球供應鏈波動風險。

強化製造運營的敏捷性與靈活性。 公司以快速反應為核心指導原則,推動綜觀全域的計劃,包括審慎擴產及產能有序爬坡,平衡需求、訂單排程及勞動力供應,以快速響應市場需求變化和穩固生產效率。

持續推進數字化轉型。 公司將繼續落實長期數位化轉型戰略,藉助自動化技術與研發能力提升產品開發效率,並優化整體運營表現,以增強盈利能力與財務穩健性。

平衡訂單與定價策略。 為實現可持續增長,集團將採取平衡數量與價格的策略,結合“運動休閒”消費趨勢,積極尋求優質訂單,優化產品群組,提高整體銷售品質。

流程優化提升盈利能力。 製造業務銷售規模提升推動營運槓桿效益的同時, 公司推動組織暨流程優化,並通過靈活調度產能、有序加班計劃及新增產能穩步爬坡,加上降本增效推升盈利能力。

推進全管道零售生態圈建設

公司零售附屬公司寶勝將繼續通過其精緻化零售策略,動態佈局實體及全管道零售版圖,引進新門店格局、豐富產品類別矩陣,並致力卓越營運。 其亦將繼續擴大與業務夥伴的策略夥伴關係,並通過動態庫存管控、高效營運資金管理,以鞏固寶勝的獲利率及股東回報。

Yue Yuen’s robust manufacturing business sales surged 9% yoy in June and continued to cushion retail weakness. This affirms plans to invest into India and Indonesia to diversify its global production network, in view of the latest US tariff trajectory. We maintain our BUY call on the stock.

The gist: BUY

· June 2025: manufacturing revenue rose 9% yoy to cushion total business

· Latest Vietnam-US trade deal adds certainty on tariff burden allocations

· Manufacturing business: a diverse production network for better resilience

June 2025: manufacturing revenue grew 9% yoy to underpin total business

Yue Yuen Industrial (YY) released revenue data for June 2025 on 10 July:

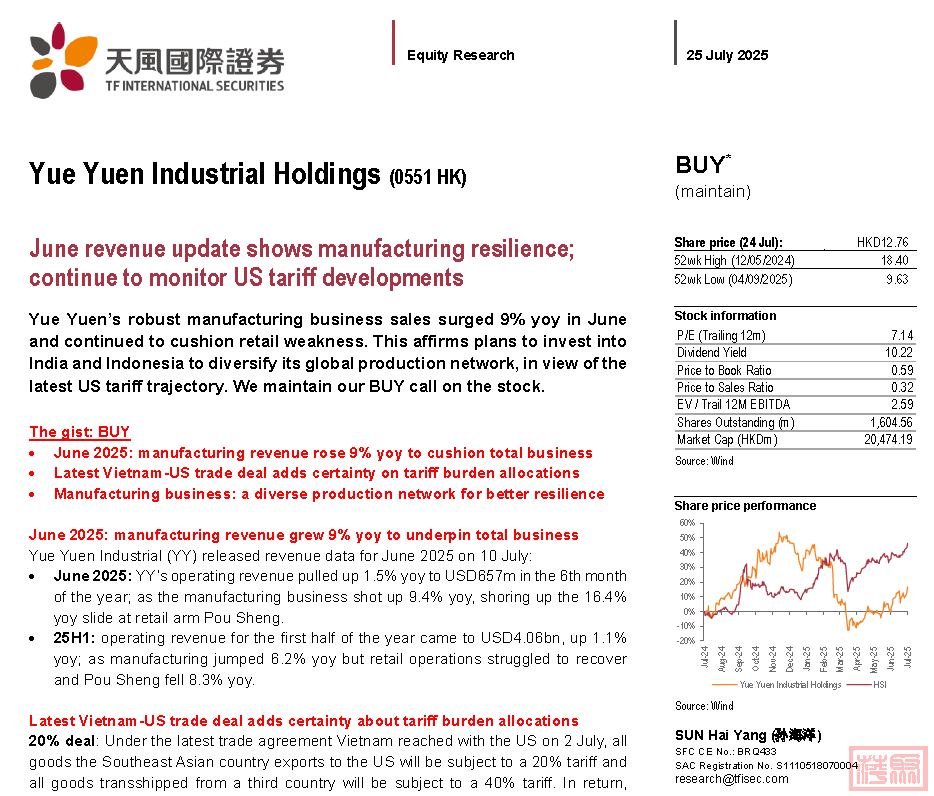

· June 2025: YY’s operating revenue pulled up 1.5% yoy to USD657m in the 6th month of the year; as the manufacturing business shot up 9.4% yoy, shoring up the 16.4% yoy slide at retail arm Pou Sheng.

· 25H1: operating revenue for the first half of the year came to USD4.06bn, up 1.1% yoy; as manufacturing jumped 6.2% yoy but retail operations struggled to recover and Pou Sheng fell 8.3% yoy.

Latest Vietnam-US trade deal adds certainty about tariff burden allocations

20% deal: Under the latest trade agreement Vietnam reached with the US on 2 July, all goods the Southeast Asian country exports to the US will be subject to a 20% tariff and all goods transshipped from a third country will be subject to a 40% tariff. In return, Vietnam will fully open its market and allow the import of US goods for zero tariffs.

Major US apparel trade partner: Vietnam being a major importer of US textiles and apparel, the latest tariff framework adds certainty about the tariff burden allocation for both apparel brands and manufacturers. With Vietnamese manufacturers and US importers each bearing their own tariff costs, the arrangement would fall within a scope that is manageable for both parties.

Export stability: The trade agreement also adds stability to YY’s export orders, as Vietnam is part of the company’s manufacturing operations network and the US is its second-largest market. Production capacity utilization was high in 2024 on 4% more footwear shipments, which made up 31% of total shipments. YY’s US market revenue accounted for 19% of the total.

Manufacturing business: a diverse production network for better resilience

· Diverse capacities: YY’s production strategy is diverse allocations of capacities to help it manage global supply chain fluctuations. It intends to accelerate its capacity buildout over the mid to long term, and has prioritized investments into Indonesia and India. These respective South-east Asia and South Asia countries have ample labor supply and infrastructure, and could thus potentially drive sustainable growth.

· Elastic operations: The company is pushing a comprehensive plan for elastic operations to drive its core principle of quick market response. This entails prudent production capacity expansion and a smooth ramp-up, while balancing demand volumes with order scheduling and labor supply. These measures would drive steady production efficiency and allow quick responses to market demand changes.

· Digital restructure: YY’s long-term digital restructure strategy involves automation technologies and R&D capabilities, which would increase product development efficiency and operating performance, enhancing profitability and financial stability.

· Priced to order volume: To help sustain growth, the company set a new pricing strategy that correlates order price to order volume. And to align with current sports and leisure trends in consumer apparel, YY would optimize its product mix and seek better-quality orders to raise total sales quality.

· Process improvements: YY’s operating leverage increases with higher sales volumes in the manufacturing business, so it is pushing to optimize organizational and processes. It aims to raise profitability through elastic capacity scheduling, orderly overtime plans and the steady ramp-up of new capacity, as well as reduce costs and tighten efficiencies.

Retail business to continue to flesh out plans for omnichannel ecosystem

· Premiumization: Subsidiary Pou Sheng intends to keep implementing a premium retail strategy and build out physical market and other channels dynamically. It will launch new store formats, enhance the product category mix and improve operational efficiencies.

· Strategic collabs: The company will continue to expand strategic partnerships with its business partners, and enhance inventory management and working capital efficiency to raise Pou Sheng’s profit margins and shareholder returns.

投資建議/Investment Ideas

維持盈利預測,維持買入評級

我們預計公司25-27年營收分別為84億美元、89億美元以及95億美元; 歸母凈利分別為4.0億美元、4.3億美元以及4.8億美元;對應EPS分別為0.25美元、0.27美元以及0.30美元;對應PE分別為6x、6x、5x。

Valuation and risks

Our 2025/26/27E forecast has revenue at USD8.4bn/8.9bn/9.5bn and net profit at USD400m/430m/480m, implying USD0.25/0.27/0.30 EPS at 6x/6x/5x PE. We maintain our BUY rating.

風險提示:消費景氣度不及預期,關稅變化,產能爬坡進度不及預期,市場競爭激烈。

Risks include: weaker consumer market dynamics than expected; unfavorable tariff structure changes; production capacity expansion pacing more slowly than expected; and intensifying competition.

Email: research@tfisec.com

TFI research report website:

(pls scan the QR code)

本文件由天風國際證券集團有限公司, 天風國際證券與期貨有限公司(證監會中央編號:BAV573)及天風國際資產管理有限公司(證監會中央編號:ASF056)(合稱“天風國際集團”)編制,所載資料可能以若干假設為基礎,僅供作非商業用途及參考之用途,會因經濟、市場及其他情況而隨時更改而毋須另行通知。任何媒體、網站或個人未經授權不得轉載、連結、轉貼或以其他方式複製發表本檔及任何內容。已獲授權者,在使用本檔或任何內容時必須注明稿件來源於天風國際集團,並承諾遵守相關法例及一切使用的國際慣例,不為任何非法目的或以任何非法方式使用本檔,違者將依法追究相關法律責任。本檔所引用之資料或資料可能得自協力廠商,天風國際集團將盡可能確認資料來源之可靠性,但天風國際集團並不對協力廠商所提供資料或資料之準確性負責。且天風國際集團不會就本檔所載任何資料、預測及/或意見的公平性、準確性、時限性、完整性或正確性,以及任何該等預測及/或意見所依據的基準作出任何明文或暗示的保證、陳述、擔保或承諾而負責或承擔任何法律責任。本檔中如有類似前瞻性陳述之內容,此等內容或陳述不得視為對任何將來表現之保證,且應注意實際情況或發展可能與該等陳述有重大落差。本檔並非及不應被視為邀約、招攬、邀請、建議買賣任何投資產品或投資決策之依據,亦不應被詮釋為專業意見。閱覽本文件的人士或在作出任何投資決策前,應完全瞭解其風險以及有關法律、賦稅及會計的特點及後果,並根據個人的情況決定投資是否切合個人的投資目標,以及能否承擔有關風險,必要時應尋求適當的專業意見。投資涉及風險。敬請投資者注意,證券及投資的價值可升亦可跌,過往的表現不一定可以預示日後的表現。在若干國家,傳閱及分派本檔的方式可能受法律或規例所限制。獲取本檔的人士須知悉及遵守該等限制。

|

|